How will Section 24 impact cashflow? The Section 24 tax changes, announced in 2015, limit tax relief on finance costs for private landlords on residential properties to the basic rate of Income Tax. These changes have been gradually implemented over four years, starting from April 6, 2017, to allow buy-to-let landlords time to adjust.

What Is Section 24?

Section 24 of the Finances Act 2015, active since the tax year 2020, reduces tax relief for landlords, increasing tax liability for residential property investors. Before Section 24, landlords deducted mortgage interest and other property financing costs. Now, these expenses can’t be deducted from rental profits pre-tax, resulting in landlords paying tax on the full amount and claiming back only a portion.

What is the impact of Section 24?

Buy-to-Let landlords often use mortgages to finance their property investments, either for individual properties or their entire portfolio. This approach allows them to leverage their capital more effectively, typically to acquire more properties or make improvements. However, Section 24 has introduced complications in this regard.

Furthermore, landlords have historically relied on capital appreciation to support their lifestyle expenses, often through remortgaging. The combined impact of Section 24 and the Prudential Regulation Authority’s stricter rules, which subject portfolio landlords to stress tests and similar regulations as other businesses, has made this method of funding lifestyle expenses more challenging.

As a consequence of these changes, there is early evidence indicating a consolidation within the private rented sector. This involves a smaller number of landlords, as some exit the market, while others seize opportunities to expand their property portfolios.

How does Section 24 work?

Section 24 represents a significant change for landlords, as it mandates that they must pay income tax on their entire rental income, with the option to claim back a maximum of 20% in tax relief.

To illustrate how this works, consider an example: Let’s assume your rental income amounts to £15,000, and your interest payments on the property amount to £5,000.

- Firstly, you will be required to pay tax on the full rental income.

- For basic rate taxpayers (taxed at 20%), this tax would amount to £3,000. For higher rate taxpayers (taxed at 40%), the tax would be £6,000.

- You can then claim back 20% of your interest payments, which is £1,000 (as £1,000 represents 20% of £5,000).

- Consequently, basic rate taxpayers would pay a total of £2,000 in tax, while higher rate taxpayers would pay £5,000 in tax.

This example illustrates that Section 24 has a more substantial impact on higher-rate taxpayers. The intention behind this is to dissuade potential landlords from entering the private rental sector.

Will Section 24 Impact my Property Business?

For basic rate taxpayers, the tax changes shouldn’t result in immediate financial loss. They’ll pay 20% income tax and receive a 20% tax credit on finance costs, balancing out.

Higher rate taxpayers, however, face a tax increase of at least 20p for every pound of interest paid. This impacts property deals and necessitates careful consideration.

Regardless of tax status, landlords must forecast the effects. Section 24 can push landlords into higher tax brackets, even shifting them from basic to advanced rates, as seen in a 400% rise in taxable profit for some.

How will Section 24 impact cashflow?

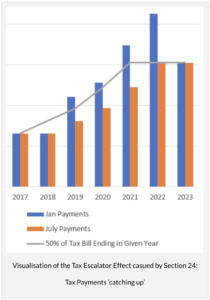

Many landlords may face a cashflow crisis in the coming years due to their delayed response to Section 24, a concern rooted in the workings of the UK tax system. The graph illustrates that 2022 presents the most challenging year in terms of cashflow. The lag in tax payments catching up with actual tax bills contributes to this predicament.

This cashflow challenge highlights the importance of proactive financial planning for landlords. Being prepared for the evolving tax landscape and its impact on rental income is crucial to navigate the potential hurdles that lie ahead.

What counts as ‘Finance Costs’ in Section 24?

Section 24, as it relates to residential landlords, primarily affects their financial expenses, which encompass:

- Mortgage interest

- Interest on loans used to purchase furnishings

- Fees associated with mortgage or loan origination and repayment

It’s essential to note that tax relief typically doesn’t apply to the capital repayments of a mortgage or loan. The tax credit pertains specifically to the finance costs that have been recently disallowed under Section 24. This distinction is crucial for landlords to understand the precise scope of the tax changes.

Does Section 24 affect Companies?

Limited companies holding residential property are currently still able to claim finance costs as an allowable expense. Sole Traders and Partnerships, including Limited Liability Partnerships (LLPs) however are all impacted by the Section 24 tax changes. In some circumstances a Limited Liability Partnership can be connected with a Limited Company with the net result being that the interest is effectively deductible. This type of business planning is commonly referred to as a Hybrid Business Structure or Mixed Partnership LLP and can enable property owners to maximise the commercial benefits of building running and growing a recognised professional property business.

How Can Buy-To-Let Landlords Reduce And Manage The Impact Of Section 24?

For landlords with smaller rental income and portfolios, Section 24’s impact may be relatively minor. However, for those with larger portfolios, the tax implications could be significant. It’s essential to explore potential actions to mitigate these changes.

1. Overhaul operating costs: Reducing expenses in property management can help offset Section 24-related losses. Transitioning from using a property management company to self-management can significantly cut overhead costs.

2. Refinance properties: With current low interest rates due to the post-pandemic economic recovery, refinancing your properties for better financing rates is a viable option.

3. Consider commercial properties or holiday lets: Section 24 only applies to residential properties. Shifting investments to commercial properties or holiday lets could circumvent the ruling, but thorough consideration is essential.

4. Incorporate rentals into a limited company: Section 24 doesn’t apply to limited companies. Incorporating your properties can help avoid this tax change, but it involves various costs, such as stamp duty and capital gains tax, when transferring properties to the company.

5. Set up a beneficial interest company trust: Similar to becoming a limited company, this structure allows you to transfer your portfolio and bypass Section 24 tax changes while maintaining personal ownership. However, it has implications like corporation tax and potential remortgaging issues, so professional advice is crucial.

6. Increase rent: Modest rent hikes could offset Section 24 expenses, but careful consideration is needed to avoid moving into a higher tax bracket.

7. Reduce portfolio size: Reviewing the finances of each property and selling underperforming assets can streamline your investments in the current climate.

More Section 24 Blogs HERE:

Can I Avoid The Section 24 Tax Completely?