In 2015, a significant change in the UK tax code, known as Section 24, was unveiled, causing ripples in the world of landlords. This alteration, fully effective by April 2020, reshaped the tax relief landscape for property owners.

Let’s dive into the mechanics of Section 24 and its repercussions on rental income, as well as the available remedies. Put simply, Section 24 eliminates the landlord’s ability to deduct mortgage interest and other financing costs from rental income when calculating tax liability. Instead, landlords can only claim a 20% tax credit based on loan and mortgage interest, starting in the 2020–2021 tax year.

Why Section 24?

Section 24, introduced in 2015, aims to level the playing field, particularly for landlords with higher incomes. Then-Chancellor George Osborne spotlighted the perceived inequality in his Summer Budget 2015 address.

Osborne’s rationale was straightforward: buy-to-let landlords enjoyed a significant edge in the property market, deducting mortgage interest from their income, a privilege denied to homebuyers. Furthermore, the wealthier the landlord, the greater the tax relief, creating what he considered an imbalance in the tax system.

Understanding Tax Relief Changes

Section 24 has ushered in substantial changes in how landlords are taxed on income from residential rental properties. In the pre-Section 24 era, landlords could deduct mortgage interest from their income tax. They could also claim deductions for various rental property expenses, such as mortgage admin fees or loans for furnishing.

However, with the advent of Section 24, landlords now face taxation on the entirety of rental income. Their only reprieve is the ability to claim back mortgage interest costs, limited to 20%—equivalent to the basic rate of income tax.

This shift translates into increased upfront tax payments for landlords. Additionally, if they have other sources of income, like a job salary, their rental income may push them into higher tax brackets, leading to an overall higher tax liability.

In essence, Section 24 prohibits landlords from offsetting finance charges against their gross profit when calculating tax liabilities. This change may push landlords on the brink of a higher tax bracket into that next tier. The rise in gross income can also affect other financial aspects, including student loan repayments, child tax credits, and child benefits, all contingent on income changes.

Tax Relief for Landlords in 2023

Under the restructured tax rules of Section 24, landlords qualify for a 20% tax credit based on the lowest of three factors:

1. Finance costs, encompassing mortgage interest, loans for furnishing purchases, and related fees.

2. Property business profits.

3. Adjusted total income.

This adjustment implies that landlords can no longer fully deduct finance costs, including mortgage interest, from rental income for tax purposes. Instead, they receive a 20% tax credit based on the lowest of these three elements.

Who’s Affected by Section 24 and Its Tax Relief Changes?

The impact of these tax relief rules extends broadly, affecting individual landlords in the private rented sector. This includes various scenarios:

- UK-resident landlords renting out properties in the UK or abroad.

- Non-UK resident landlords with UK rental properties.

- Landlords using partnerships to let properties.

- Landlords operating as limited liability companies, subject to a distinct tax system, allowing them to declare rental income after accounting for mortgage costs.

The government’s policy paper on finance cost relief estimated that only a fifth of individual landlords would experience reduced relief under the new regulations. Notably, higher-earning landlords shoulder the primary impact of these changes.

Consequently, landlords must now pay tax on their gross rental income, potentially pushing some into higher tax brackets.

Government Response to the Petition for Full Tax Relief Reinstatement

The impact of Section 24 on the rental property market prompted a petition signed by many landlords. This petition highlights the consequences of Section 24 on the rental stock and the potential benefits of restoring full relief.

Signatories, including Marc von Grundherr, Director of Benham and Reeves, emphasize these changes’ significant influence. According to a landlord survey, 73% of those contemplating exiting the sector would reconsider if Section 24 changes were reversed.

In response, the government remains firm in setting mortgage interest relief against rental income at the basic tax rate. Their aim is to maintain fairness within the income tax system and avoid granting landlords advantages beyond what homeowners receive.

While the petition faces further challenges, it could trigger a parliamentary debate if it reaches 100,000 signatures.

Understanding the Change in Interest Relief

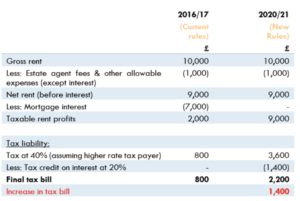

Before the tax year 2016/17, individual residential landlords paid taxes based on their net rental profits. This calculation involved deducting eligible property expenses and mortgage interest from gross rental income.

Before the tax year 2016/17, individual residential landlords paid taxes based on their net rental profits. This calculation involved deducting eligible property expenses and mortgage interest from gross rental income.

Due to the gradual implementation of interest rate relief restrictions, starting in the tax year 2016/17 and fully in effect by the tax year 2020/21, landlords can no longer deduct mortgage interest as an expense. Instead, they receive a 20% tax credit against their tax liability.

In practice, this means that landlords may face a tax bill higher than their net rental income, resulting in a loss after tax. In some cases, the effective tax rate on net rental profits can soar to 220%.

Mitigating Section 24’s Impact on Your Portfolio

To alleviate Section 24’s impact and manage changes in interest relief, landlords have various options beyond raising rent, which may not always be effective:

1. Market Dynamics: Rental rates are market-driven. Overpricing can lead to longer vacancies and financial losses. Aligning rent with market rates is crucial.

2. Property Upgrades: Justifying higher rent with property improvements can lower your property’s value and tax bracket.

Alternative strategies include reviewing operating expenses, self-managing properties, exploring remortgaging, and diversifying into commercial property investments. Consultation with financial and property experts is advisable to tailor solutions to individual circumstances.

MORE Buy To Let blogs HERE:

Buy-To-Let VS Residential Mortgage

Tips for First-Time Buy-to-Let Investors UK

How to Choose the Right Buy-to-Let Property

Essential Guide to Buy-to-Let Home Insurance in the UK

Getting a Buy-to-Let Loan with Poor Credit

The Benefits of Buy-to-Let Mortgages

Can My Mortgage Be Interest-only?

Starting Your Buy-to-Let Business: A Guide

Who is eligible for a buy-to-let mortgage?

Property Investment: The Buy-to-Let Mortgage Essentials

Choosing Between Holiday Lets and Buy to Lets

Airbnb Hosting vs. Buy-to-Let: Tax and More

Airbnb vs. Traditional Rentals: Maximizing Returns

Navigating Buy-to-Let Mortgages for First-Time Buyers

Stamp Duty on Buy-to-Let Properties

Can I Use The Equity In My Home As A Deposit?

What is Section 24 A? Basic Guide for Landlords